Understanding Your Payslip

Despite its significance, the importance of a payslip is often overlooked.

A payslip serves as a critical document verifying employment, income, and tax compliance, yet its value extends beyond transactional purposes. It provides transparency into salary breakdowns, deductions, and benefits, empowering employees to manage finances, track expenses, and plan for taxes.

Moreover, payslips are essential for loan applications, credit assessments, and social security benefits. Overlooking payslip accuracy or neglecting to provide detailed information can lead to financial discrepancies, tax issues, and employee dissatisfaction, underscoring the need for precise and timely payslip generation. Your payslip is important for the following reasons:

Employee Rights & Benefit Claims

Serves as evidence of the terms of employment and the deductions made from the employee’s earnings. This is important in ensuring that employees are paid the correct amount and that their rights are protected.

Record of Earnings

This is important for tax purposes, as the employee may need to provide proof of income to government agencies or financial institutions.

Tax Purposes

The payslip contains information to ensure that the correct amount of tax is being paid.

Budgeting

Your payslip indicates the benefits you do not have to acquire for yourself. Eg. Group Life Cover, Funeral Cover etc. You are able to budget accordingly with this information.

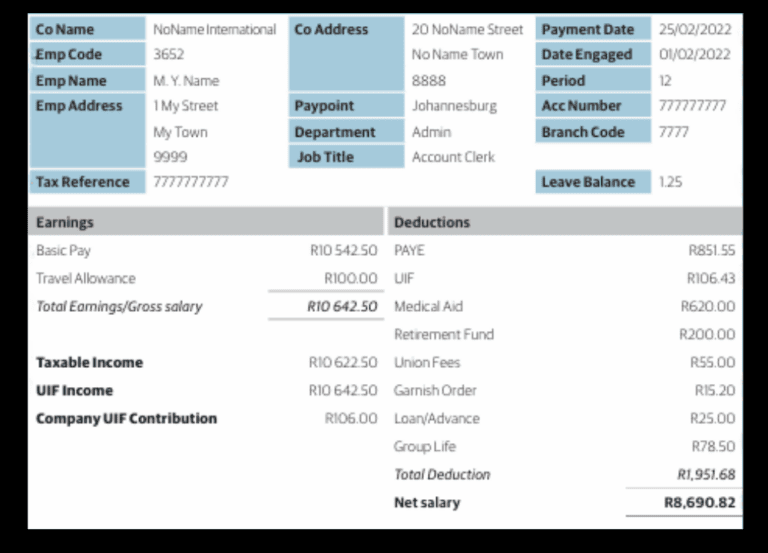

A Typical Payslip includes

Deductions: Income Tax (PAYE - Pay As You Earn), UIF (Unemployment Insurance Fund), Medical Aid, Pension/Retirement Fund, Other Deductions (e.g. Union Fees, Garnishee Orders

Employer Information: Company Name, Company Address, Company Tax Number / VAT Number

Employee Information: Name, Employee Number, TAX / SA ID Number, Job Title, Employee Address, Status: Perm/Temp, Date Engaged with Company, Leave Information & Balances, Payment Information, Pay Date, Pay Period (e.g. monthly/weekly), Gross Pay (total earnings before deductions), Net Pay (take-home pay after deductions), Rate Per Hour, Bank Details of Employer (may include: PAYE & UIF Reference Number, Employee Tax Certificate (IRP5/IT3(a)) details, IRP5: Employer's copy of Tax Certificate submitted to SARS, IT3(a): Employee's copy of the tax certificate for personal tax returns)

Annual Package typically refers to the total yearly compensation or remuneration an employee receives from their employer. This package usually consists of:

Basic Salary: The employee’s monthly salary, paid out 12 times a year.

Annual Bonus: A once-a-year payment, often based on individual or company performance.

Leave Allowance: Paid time off, such as vacation days, sick leave, and family responsibility leave.

Other Allowances: Depending on the company, this might include allowances for things like housing, meals, or entertainment.

Benefits: Contributions to Medical Aid, Retirement Fund (Pension/Provident), Life Insurance, Disability Insurance, Company Specific Benefits

Travel & Cellphone Allowance: A monthly or annual allowance for work-related travel & cellphone expenses

Net Pay

The net salary, also known as the take-home pay, is the amount of money an employee receives after all deductions and taxes have been subtracted from their gross salary. The net salary is calculated by subtracting the following from the gross salary:

Income tax (PAYE – Pay As You Earn)

Unemployment Insurance Fund (UIF) contributions

Skills Development Levy (SDL) contributions

Medical aid contributions (if applicable)

Retirement fund contributions (if applicable)

Other deductions (e.g., life insurance, disability insurance, etc.)

Bonuses

Bonuses are typically calculated as a percentage of an employee’s basic salary or as a fixed amount.

Percentage of basic salary: A percentage of the employee’s basic salary, e.g., 10% or 20%.

Fixed amount: A predetermined fixed amount, e.g., R10,000 or R20,000.

Performance-based: Linked to individual or company performance targets, e.g., meeting sales targets or achieving specific goals.

Discretionary: Awarded at the employer’s discretion, often based on individual performance or contributions.

Guaranteed: A guaranteed bonus, often paid annually, e.g., a 13th cheque.

Some bonuses, like performance-based or discretionary bonuses, may have specific conditions or criteria to meet before payment. Always check the employment contract or company policies for details.

Allowances

Overtime Pay

Overtime is calculated according to the Basic Conditions of Employment Act (BCEA).

Normal working hours: Determine the employee’s regular working hours per week (usually 45 hours).

Overtime threshold: Identify the overtime threshold, which is:

45 hours/week for most employees

50 hours/week for:

- Employees who earn above the threshold (currently R205,433.30 per year)

- Employees who work in certain industries (e.g., agriculture, domestic work)

Overtime hours: Calculate the number of hours worked beyond the threshold.

Overtime rate: Determine the overtime rate, which is:

- 1.5 times the regular hourly rate for the first 10hrs of overtime p/week

- 2 times the regular hourly rate for hours worked beyond 10hrs of overtime p/week

Overtime pay: Calculate the overtime pay by multiplying the overtime hours by the overtime rate

What no-one tells you about your first payslip | Standard Bank

You’ll have certain expectations about earning your first salary; in fact, you probably already know how you’re going to spend it, but many new employees are surprised when the amount that hits their bank account differs from their salary. That’s thanks to all the deductions and new financial responsibilities and considerations you’re dealing with.

Basic Guide to Payslips | Department of Employment & Labour

Understanding Your Pay Slip: A Guide for Employees